ESG - Mapping SEC Product Categories to FCA Classifications

Back in November 2022, we posted a brief article on SDR vs. SFDR fund classifications, how they will differ going forward, and the outline considerations to be made when determining how funds/products will be classified. However, we did not talk about the SEC and how the categories under SEC rules will apply to the FCA regime.

SEC Categories

Instead of categorising funds as Article 6, Article 8, or Article 9, the SEC has used a different nomenclature which essentially translates to a very similar standard as to the FCA's. These are:

- Integration – integrate ESG factors alongside non-ESG factors in investment

- ESG-Focused – ESG factors are a significant or main consideration

- Impact – ESG-Focused Funds that seek to achieve a particular ESG impact

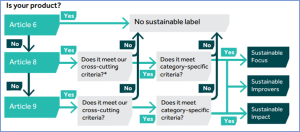

The way that these SEC categories translate to FCA classifications is best summarised by the following diagram (sourced from the FCA CP22/20). Once again, the cross-cutting and category specific factors will need to be applied. We will follow up on this series of posts talking further about each of these considerations

We listen to your needs

We understand your challenges

We provide solutions

We help with implementation